Table of Content

Written By

GHR Global

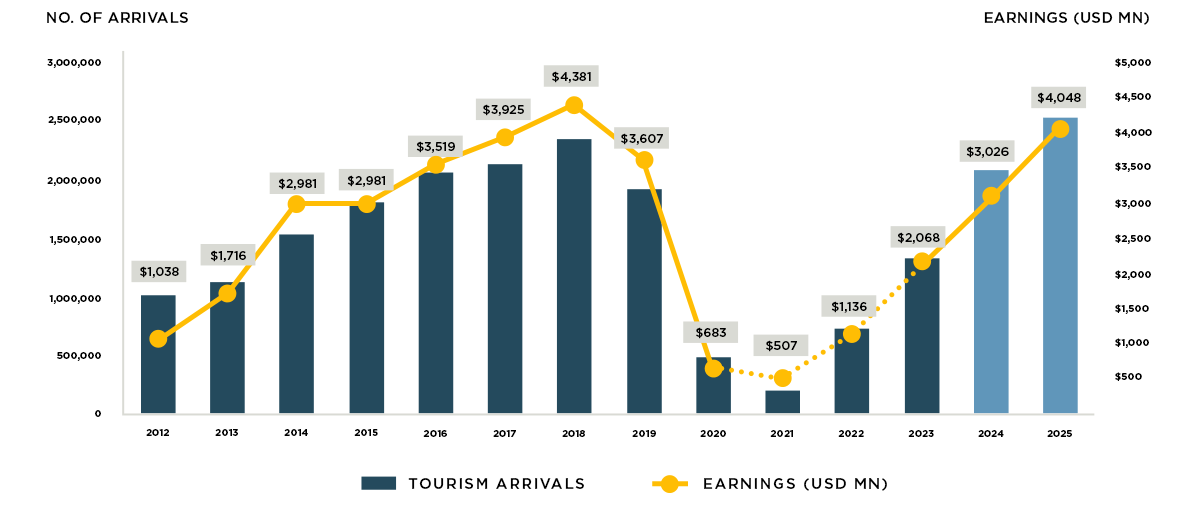

Digital Marketing TeamSri Lanka’s tourism sector is rapidly recovering, with 2.1 million tourist arrivals expected in 2024, generating approximately USD 3 billion in revenue. As travel resumes and demand for unique vacation experiences grows, hotel residencies beyond Colombo are becoming prime investments. This article explores the latest tourism trends and demonstrates how GHR’s strategically located hotel residencies provide lucrative opportunities for investors seeking rental income and long-term capital appreciation.

Source - SLTDA / First Capital

Growing Tourist Arrivals: A Booming Market

Sri Lanka’s tourism industry saw a remarkable 61.7% rise in tourist arrivals during the first half of 2024. This surge signals a robust recovery from recent challenges, driven by the return of global travel and the appeal of Sri Lanka’s scenic landscapes, pristine beaches, and cultural heritage. Forecasts suggest that by the end of 2024, 2.1 million visitors will contribute to the tourism sector’s earnings of USD 3 billion.

By 2025, Sri Lanka aims to surpass pre-pandemic tourism levels with 2.5 million arrivals expected. This growth provides a favorable environment for real estate investors, particularly in hotel residencies located in popular vacation destinations.

Tourism Demand Shifting Outside Colombo

Colombo’s hotel occupancy rates have been impacted by the Minimum Room Rate (MRR) policy, which sets a price floor for city hotels. Consequently, MICE tourism (Meetings, Incentives, Conferences, and Exhibitions)—a key source of business travel—has shifted to alternative regional destinations.

Tourists are now drawn to scenic coastal resorts, hill country retreats, and cultural hotspots outside of Colombo, increasing demand for vacation rentals and serviced apartments. This shift presents an opportunity for hotel residencies to meet the growing need for flexible, high-quality accommodations in emerging tourist destinations.

Hotel Residencies: The Ideal Investment Opportunity

Hotel residencies offer a range of benefits to investors, including:

- Consistent Rental Income: High occupancy during peak travel seasons ensures reliable cash flow.

- Long-Term Property Appreciation: Property values in tourist-heavy regions are poised for steady growth as demand increases.

GHR’s hotel residencies provide investors with the opportunity to earn rental income while benefiting from capital appreciation. Whether beachfront apartments or highland escapes, these properties align perfectly with Sri Lanka’s evolving tourism landscape.

How GHR’s Hotel Residencies Lead the Market

GHR’s portfolio of hotel residencies is designed to meet market trends and maximize investment returns. Key advantages include:

- Prime Locations: Positioned in high-demand areas such as coastal towns and scenic hill regions, ideal for leisure travelers.

- Modern Infrastructure: Equipped with top-tier amenities to attract long-stay guests and vacationers.

- Secure Investment: GHR ensures timely delivery through diversified funding strategies, reducing risks for investors.

GHR’s hotel residencies are not just properties—they are opportunities to capitalize on Sri Lanka’s tourism boom while enjoying stable returns.

Invest in Sri Lanka’s Tourism-Fueled Real Estate Market

As tourism in Sri Lanka accelerates, hotel residencies offer an exceptional investment path. With the industry shifting towards high-demand regions outside of Colombo, GHR’s developments are perfectly positioned to meet market needs, offering reliable rental income and future growth potential.

As Sri Lanka aims to surpass pre-pandemic tourist arrivals by 2025, now is the ideal time to invest in hotel residencies and secure long-term returns. Explore GHR’s projects today to discover how our hotel residencies can help you tap into the booming tourism sector and achieve your financial goals.

Sources - Condominium Market Survey and Real Estate Property Price Indices Report by Central Bank of Sri Lanka, Sri Lanka Tourism Development Authority, and First Capital Investment Banker