Table of Content

Written By

GHR Global

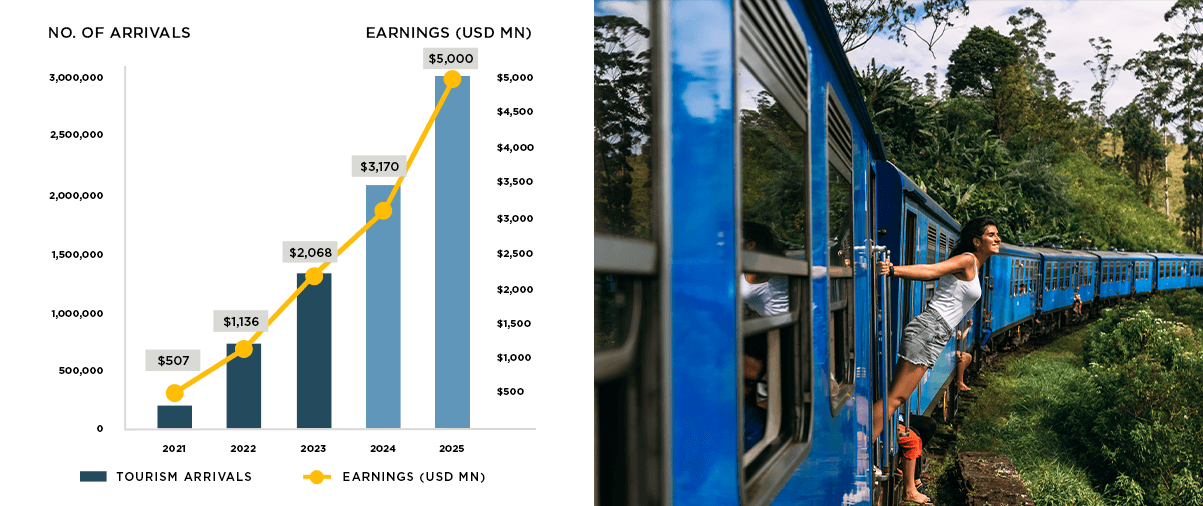

Digital Marketing TeamSri Lanka’s tourism sector is experiencing unprecedented growth, with over 2 million international arrivals recorded in 2024 and an ambitious target of 3 million visitors in 2025. The Sri Lanka Tourism Development Authority (SLTDA), under the leadership of newly appointed chairman Buddhika Hewawasam, is introducing strategic reforms and infrastructure developments to drive further growth and position Sri Lanka as a top global travel destination.

Sources - Sri Lanka Tourism Development Authority Statistics

With the tourism sector playing a pivotal role in Sri Lanka’s economic recovery, demand for luxury accommodations in key tourist hubs is at an all-time high. Hotel residencies have become the top-performing real estate investment, offering both personal vacation use and passive rental income in high-demand locations.

GHR’s Ocean Breeze Negombo Hotel Residencies has set a benchmark for high-yield hospitality investments, delivering over 200% ROI to investors. With Negombo’s strong tourism potential, a future Phase 2 is being explored, providing investors an opportunity to capitalize on the success of the original development.

With 37.5% tourist arrival growth in 2024, and a projected 50% expansion in 2025, GHR’s hotel residencies present a low-risk, high-reward real estate opportunity in Sri Lanka’s thriving tourism sector.

Why Hotel Residencies in Sri Lanka’s Tourist Hotspots Are a Smart Investment

Sri Lanka is targeting 3 million tourist arrivals and $5 billion in tourism revenue by 2025, reinforcing its position as a premier global travel destination. As international visitor numbers surge, demand for high-end accommodations in top tourist locations is escalating. The government is aggressively promoting tourism-friendly policies, enhancing infrastructure, and simplifying visa regulations, ensuring steady market expansion for investors in the hospitality sector.

The success of Ocean Breeze Negombo, which delivered an ROI of over 200%, highlights the profitability of beachfront hotel residencies. Investors who missed out on this opportunity are now anticipating the next phase of development, as the demand for luxury beachfront properties continues to grow.

Sri Lanka’s tourist arrival grew by 37.5% in 2024 and is projected to expand by another 50% in 2025, marking one of the fastest economic recoveries in the region. This rapid growth, combined with capital appreciation exceeding 120% in high-demand tourist areas, positions hotel residencies as one of the most lucrative real estate assets in Sri Lanka.

Ocean Breeze Negombo: A Proven Success Story Expands

Located on Negombo’s scenic coastline, Ocean Breeze Negombo has redefined luxury beachfront living, offering strong rental yields and significant capital appreciation. Positioned just minutes from Bandaranaike International Airport, the development has established itself as a prime hospitality investment, catering to a steady influx of travelers seeking comfort, convenience, and oceanfront luxury.

With a fully managed hospitality model, investors have enjoyed hassle-free ownership while benefiting from high occupancy rates and long-term value appreciation. The success of Ocean Breeze Negombo serves as a case study for why beachfront hotel residencies remain one of the most profitable investment options in Sri Lanka.

Recognizing the continued rise in tourist arrivals and demand for premium accommodations, GHR is exploring the potential for a future Ocean Breeze Negombo Phase 2, aiming to replicate the success of Phase 1 and offer investors another opportunity to enter the thriving hospitality sector. While Phase 2 is still in the planning stage, the continued demand for beachfront properties in Negombo makes it a location that investors should keep a close eye on.

Vacation and Profit: The Dual Benefits of Owning a Hotel Residency

Investing in a hotel residency offers a unique advantage, luxury beachfront living with the potential for passive income. The strategic positioning of properties like Ocean Breeze Negombo ensures strong rental demand, making hotel residencies an ideal dual-purpose investment.

With Sri Lanka’s hospitality sector growing rapidly, this investment offers high rental yields and long-term property appreciation, ensuring a stable and lucrative income stream for property owners.

Why GHR’s Hotel Residencies Stand Out

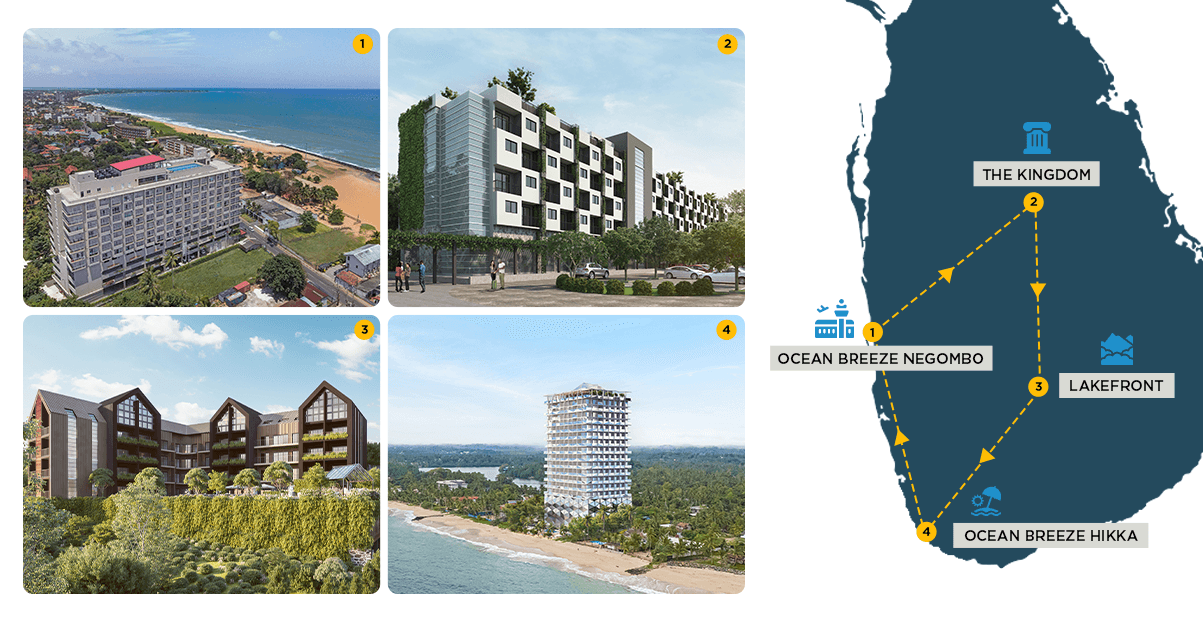

GHR’s hotel residencies are strategically developed to align with Sri Lanka’s world-famous round-tour experience, ensuring that investors benefit from consistent occupancy rates across multiple locations as international visitors travel across the island.

Starting in Negombo, where most travelers begin their journey, tourists move through Sri Lanka’s most iconic destinations, staying in GHR hotel residencies strategically positioned along their route.

- Ocean Breeze Negombo: Serves as the first and last stop for most international travelers, making it an ideal short-stay rental location.

- The Kingdom, Sigiriya: A central hub for Sri Lanka’s rich historical and cultural attractions, drawing thousands of tourists daily.

- The Lakefront Nuwara Eliya: A must-visit for luxury hill country retreats, tea plantation tours, and eco-tourism experiences.

- Ocean Breeze Hikkaduwa: The final stop for travelers looking to relax on the beach, surf, or enjoy Sri Lanka’s coastal nightlife, before returning to Negombo to fly out.

By investing in GHR hotel residencies, investors can capitalize on Sri Lanka’s established tourism routes, ensuring a steady flow of guests and consistent rental income year-round. Each GHR hotel residency is professionally managed, offering investors a fully hands-off ownership experience while maximizing rental income potential.

Strong Capital Gains and High Rental Income Potential

Investing in hotel residencies in high-demand locations like Negombo, Sigiriya, and Hikkaduwa provides exceptional long-term capital appreciation, with market trends showing returns exceeding 120%. Sri Lanka’s government is making significant investments in tourism infrastructure, expanding global airline connections, and simplifying visa processes to ensure continued growth. These initiatives are expected to further increase demand for luxury accommodations, reinforcing the profitability of well-positioned hotel residencies. With Sri Lanka’s tourism revenue projected to hit $5 billion by 2025, and tourist arrivals surpassing 2 million in 2024 with a target of 3 million in 2025, the hospitality industry is at the forefront of the country’s economic resurgence, and hotel residencies are positioned as one of the strongest real estate investments in the country.

The 200% ROI success of Ocean Breeze Negombo proves that luxury beachfront hotel residencies offer both strong rental income and long-term value appreciation. With the potential for a future Ocean Breeze Negombo Phase 2, investors should keep a close watch on the opportunities unfolding in this high-demand location.

For those looking to own a high-performing investment property in Sri Lanka’s top tourist hubs, GHR’s hotel residency developments remain one of the most promising opportunities in the market.

Sources - Sri Lanka Tourism Development Authority Statistics